Understanding the $5500 Payments for Social Security

Social Security helps millions of Americans every month. But did you know that some people may qualify for up to $5,500 in monthly benefits? This article explains who can receive these payments, how they work, and what steps to take to apply.

Table of Contents

Who Qualifies for $5500 Social Security Payments?

Not everyone gets $5,500 per month. The amount depends on work history, age, and earnings. Here’s how it works:

- Retirement Age: Those who retire at 70 years old receive the highest benefits.

- Earnings Record: People with high lifetime earnings may qualify for the maximum amount.

- Delayed Retirement Credits: If you delay Social Security beyond full retirement age, you get extra money.

For most retirees, the average Social Security check is around $1,800 per month, but some get much more.

Social Security Payment Breakdown

Here’s a breakdown of how Social Security calculates payments:

| Factor | Impact on Benefits |

| Retirement Age | Higher benefits if claimed at 70 instead of 62 |

| Work Earnings | More earnings = Higher monthly checks |

| Years Worked | At least 35 years of work for full benefits |

| Delayed Retirement | 8% extra per year after full retirement age |

| Social Security Cap | Maximum benefit depends on earnings cap |

The maximum benefit for 2024 is around $4,873 per month, but additional benefits can bring it closer to $5,500.

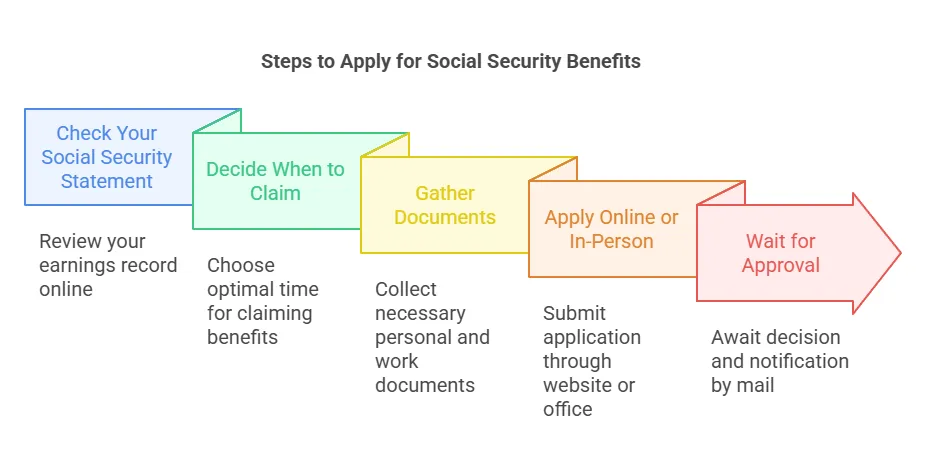

How to Apply for Social Security Benefits

If you believe you qualify, follow these steps to apply:

- Check Your Social Security Statement: Log into ssa.gov and review your earnings record.

- Decide When to Claim: Waiting longer increases your monthly payments.

- Gather Documents: You’ll need a birth certificate, work history, and tax records.

- Apply Online or In-Person: Submit your application on SSA’s website or visit a local Social Security office.

- Wait for Approval: Processing takes 4–6 weeks, and you’ll receive a decision by mail.

Additional Social Security Payment Programs

There are other benefits besides retirement payments:

- Spousal Benefits: A spouse can receive up to 50% of their partner’s benefit.

- Disability Benefits (SSDI): If you have a serious condition, you may qualify for Social Security Disability Insurance.

- Survivor Benefits: Widows or widowers may receive payments after their spouse passes away.

Comparison of Social Security Benefit Types

Here’s a look at different Social Security payments:

| Benefit Type | Eligibility | Average Payment | Max Payment |

| Retirement | 62+ years old | $1,800/month | $4,873/month |

| Spousal | Married for 10+ years | Varies | 50% of spouse’s benefit |

| SSDI | Disabled, worked enough years | $1,486/month | $3,822/month |

| Survivor | Widowed spouse or dependent | Varies | Up to 100% of deceased’s benefit |

Understanding these options can help you maximize your Social Security income.

Common Mistakes to Avoid When Applying

- Claiming too early: If you take benefits at 62, you could lose 30% of your full benefit.

- Not checking your earnings record: Mistakes in your Social Security statement can lower your payments.

- Ignoring spousal benefits: Some married couples qualify for higher payments but don’t apply.

Final Thoughts on $5500 Social Security Payments

While not everyone qualifies for $5,500 Social Security payments, understanding how the system works can help you get the highest amount possible. If you delay claiming benefits, earn more, and check your records, you may increase your monthly payments significantly.

Make sure to visit SSA.gov to check your eligibility and apply when ready.

Frequently Asked Questions (FAQs)?

Only those with high lifetime earnings and delayed retirement credits may receive this amount. Most retirees get less.

The highest benefit is $4,873 per month for those retiring at age 70 with a top earnings record.

Work at least 35 years, delay claiming until 70, and check your earnings history for m

Be First to Comment